| | | Amy B. Wechsler, M.D. Bausch Health Companies Inc. | 54

| 2024 Proxy Statement |

58

TABLE OF CONTENTS 20222023 SUMMARY COMPENSATION TABLE The following table sets forth the annual and long-term compensation awarded to or paid to the NEOs for services rendered to Bausch Health in all capacities during the years ended December 31, 2023, 2022 2021 and 2020.2021. Thomas J. Appio

Chief Executive Officer

| | | 2022 | | | 1,000,000 | | | — | | | 4,690,507 | | | 3,748,138 | | | 798,000 | | | 2,934,816 | | | 13,171,461 | | | | 2021 | | | 854,135 | | | — | | | 6,752,818 | | | 540,009 | | | 1,202,000 | | | 839,084 | | | 10,188,046 | | | | 2020 | | | 775,000 | | | — | | | 1,131,025 | | | 540,362 | | | 558,000 | | | 824,000 | | | 3,828,387 | | Tom G. Vadaketh

Executive Vice President and Chief Financial Officer

| | | 2022 | | | 600,000 | | | 500,000 | | | 5,083,699 | | | 2,574,803 | �� | | 239,472 | | | 13,725 | | | 9,011,699 | | | | | | | | | | | | | | | | | | | | | | | | | | | Seana Carson(6)

Executive Vice President and General Counsel

| | | 2022 | | | 506,590 | | | — | | | 2,667,605 | | | 824,586 | | | 202,190 | | | 11,724 | | | 4,212,695 | | | | | | | | | | | | | | | | | | | | | | | | | | | Robert A. Spurr(7)

Former President US Pharmaceutical Business

| | | 2022 | | | 336,538 | | | — | | | 861,105 | | | 874,563 | | | — | | | 2,230,891 | | | 4,303,097 | | | | 2021 | | | 636,154 | | | | | | 1,768,210 | | | 625,010 | | | 821,200 | | | 18,050 | | | 3,868,624 | | | | Joseph C. Papa(8)

Former Chief Executive Officer

| | | 2022 | | | 1,600,000 | | | | | | 8,499,996 | | | 8,499,996 | | | 1,128,000 | | | 53,769 | | | 19,781,761 | | | | 2021 | | | 1,600,000 | | | — | | | 16,561,105 | | | 2,250,054 | | | 2,448,000 | | | 29,978 | | | 22,889,137 | | | | 2020 | | | 1,526,539 | | | — | | | 8,127,907 | | | 2,251,352 | | | 2,160,000 | | | 53,563 | | | 14,119,361 | | Sam A. Eldessouky(8)

Former Executive Vice President and Chief Financial Officer

| | | 2022 | | | 700,000 | | | | | | 2,813,150 | | | 2,249,998 | | | 375,200 | | | 13,725 | | | 6,152,073 | | | | 2021 | | | 620,385 | | | — | | | 1,778,793 | | | 1,187,756 | | | 731,950 | | | 13,340 | | | 4,332,224 | | | | 2020 | | | 500,000 | | | — | | | 392,709 | | | 187,631 | | | 225,000 | | | 12,825 | | | 1,318,165 | | Christina M. Ackermann(8)

Former Executive Vice President and General

Counsel and Head of Commercial Operations

| | | 2022 | | | 750,000 | | | | | | 2,063,144 | | | 1,499,999 | | | 402,000 | | | 20,383 | | | 4,735,526 | | | | 2021 | | | 750,000 | | | — | | | 2,348,225 | | | 600,033 | | | 862,000 | | | 14,330 | | | 4,574,588 | | | | 2020 | | | 743,654 | | | — | | | 1,692,387 | | | 540,362 | | | 540,000 | | | 24,625 | | | 3,541,028 | |

| | Thomas J. Appio

Chief Executive Officer | | | 2023 | | | 1,169,231 | | | — | | | 13,133,812 | | | — | | | 1,545,000 | | | 30,535 | | | 15,878,578 | | | | 2022 | | | 1,000,000 | | | — | | | 4,690,507 | | | 3,748,138 | | | 798,000 | | | 2,934,816 | | | 13,171,461 | | | | 2021 | | | 854,135 | | | — | | | 6,752,818 | | | 540,009 | | | 1,202,000 | | | 839,084 | | | 10,188,046 | | | | John S. Barresi

Senior Vice President, Controller, Chief Accounting Officer and Interim Chief Financial Officer

| | | 2023 | | | 465,577 | | | 50,000 | | | 500,773 | | | 106,224 | | | 266,377 | | | 14,850 | | | 1,403,801 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Seana Carson(7)

Executive Vice President and General Counsel

| | | 2023 | | | 527,624 | | | — | | | 1,885,259 | | | 399,910 | | | 333,341 | | | 11,683 | | | 3,157,817 | | | | 2022 | | | 506,590 | | | — | | | 2,667,605 | | | 824,586 | | | 202,190 | | | 11,724 | | | 4,212,695 | | | | Tom G. Vadaketh(8)

Former Executive Vice President and Chief Financial Officer

| | | 2023 | | | 514,904 | | | — | | | 2,827,878 | | | 599,872 | | | — | | | 25,850 | | | 3,968,504 | | | | 2022 | | | 600,000 | | | 500,000 | | | 5,083,699 | | | 2,574,803 | | | 239,472 | | | 13,725 | | | 9,011,699 | |

(1)

| The Talent and Compensation Committee approved for Mr. Barresi to receive a bi-weekly stipend of $5,000 in addition to his regular base salary during the time he is serving as the Company’s interim CFO. |

(2)

| Represents a one-time sign-on cash retention bonus paid in 20222023 in connection with Mr. Vadaketh’s commencementBarresi’s appointment as interim Chief Financial Officer. If Mr. Barresi voluntarily resigns or is terminated for Cause (as defined in the Second Barresi offer letter) within 12 months of employment with BHC, as provided underreceiving the Vadaketh Agreement.payment he is required to reimburse the company the full amount on an after-tax basis. |

(2)(3)

| This column represents the aggregate grant date fair value computed in accordance with FASB ASC Topic 718 for all stock awards granted in 2022.2023. The grant date fair value shown here may differ from the approved value shown in the CD&A because of the accounting methodology required in this table. The grant date fair value forof the B+L Founder RSUs reflected in this column does not give effectPSUs granted to the separation-relatedNEOs during 2023 was calculated based on the probable outcome of the performance conditions applicableas of the grant date, consistent with the estimate of aggregate compensation cost to such awards. For addition details regardingbe recognized over the vestingservice period determined as of the grant date under FASB ASC Subtopic 718-10, excluding the effect of estimated forfeitures. The grant date value of the PSUs granted to these NEOs in 2023 and reported in the table above, assuming the highest level of performance conditions applicable to the B+L Founder RSUs, see page 50.will be achieved (200% of target levels), is $16,589,256 for Mr. Appio, $534,124 for Mr. Barresi, $2,010,816 for Ms. Carson and $3,016,212 for Mr. Vadaketh. Information regarding the assumptions used to value these awards is set forth in “Note 2 – Significant Accounting Policies” and “Note 13 – Share Based Compensation” to the audited consolidated financial statements included in BHC’s 2022the Company’s 2023 Annual Report on Form 10-K. The B+L TCC modified the vesting and settlement provisions of the B+L Founder RSUs held by the Former B+L NEOs during 2022 pursuant to the Papa Separation Agreement and A&R Papa Separation Agreement (in the case of Mr. Papa) and the B+L Retention Program (in the case of our other Former B+L NEOs), as described in more detail on pages 54 and 51, respectively. The B+L TCC also modified the provisions of the B+L Founder RSU held by Mr. Appio during 2022 to extend the requirement that the full distribution of B+L take place no later than December 31, 2023 (originally May 5, 2023). Unless otherwise determined by the B+L TCC, Mr. Appio’s RSUs forfeit if the full distribution of B+L does not take place on or before December 31, 2023. These foregoing modifications did not result in any incremental fair value associated with the awards. |

(3)(4)

| The amounts reflected in this column for 20222023 represent the aggregate grant date fair value computed in accordance with FASB ASC Topic 718, using Black-Scholes, excluding the effect of estimated forfeitures for all Stock Option awards granted in 2022.2023. Information regarding the assumptions used to value these awards is set forth in “Note 2 – Significant Accounting Policies” and Note 13 – Share Based Compensation to the audited consolidated financial statements included in BHC’s 2022the Company’s 2023 Annual Report on Form 10-K. The vesting and exercise provisions of the B+L Founder Stock Options held by the Former B+L NEOs were modified during 2022 pursuant to the Papa Separation Agreement and A&R Papa Separation Agreement (in the case of Mr. Papa) and the B+L Retention Program (in the case of the other Former B+L NEOs), as described in more detail on pages 54 and 51, respectively. These modifications did not result in any incremental fair value associated with the awards. |

(4)(5)

| This column represents the NEO’s 2022 BHC2023 AIP payouts (forfor Messrs. Appio and VadakethBarresi and Ms. Carson) and the 2022 B+LCarson. Mr. Vadaketh was not eligible to receive a 2023 AIP payouts (for the Former B+L NEOs), as further described beginning on page 45 under “Components of Executive Compensation — Annual Incentive Program”.payout. For additional details regarding the 2022 BHC2023 AIP, see the section titled under “Key Components of Our Executive Compensation- Annual Incentive Program” beginning on page 4643 under “Components of Executive Compensation-Annual Incentive Program.”. |

TABLE OF CONTENTS

(5)(6)

| For 20222023 amounts in this column include: |

Appio | | | 13,725 | | | | | | | | | 1,909,046 | | | 1,012,045 | | | | | | | Vadaketh | | | 13,725 | | | | | | | | | | | | | | | | | | | Carson | | | 11,724 | | | | | | | | | | | | | | | | | | | Spurr | | | 13,725 | | | | | | | | | | | | | | | | | | 2,230,891 | Papa | | | 13,725 | | | 32,564 | | | | | | | | | | | | 7,480 | | | | Eldessouky | | | 13,725 | | | | | | | | | | | | | | | | | | | Ackermann | | | 13,725 | | | | | | 6,658 | | | | | | | | | | | | |

| | Appio | | | 14,850 | | | 13,630 | | | 2,055 | | | — | | | | Barresi | | | 14,850 | | | — | | | — | | | — | | | | Carson | | | 11,683 | | | — | | | — | | | — | | | | Vadaketh | | | 14,850 | | | — | | | — | | | 11,000 | |

(A)

| Amounts shown for Ms. Carson represent company contributions under the Canadian Retirement Savings Plan and amounts for all other NEOs represent company contributions to the Retirement Savings Plan. |

Bausch Health Companies Inc. | 55

| 2024 Proxy Statement |

TABLE OF CONTENTS (B)

| Amounts include the value of Mr. Papa’s personal use of the BHC aircraft prior to the B+L IPO and the B+L aircraft from the time of the B+L IPO through the end of the fiscal year (the aggregated incremental costs to BHC and B+L for providing this benefit calculated based on all variable costs for the year, including the mileage charge for the flight, the fuel and allocable maintenance charge for the flight, as well as the ground transportation charge, in accordance with company policy on aircraft use). There was no income tax gross-up related to the personal use of BHC or B+L aircraft and Mr. Papa is solely responsible for the income tax incurred. We did not include the incremental cost of any portion of our monthly aircraft management fee, which we would have paid regardless of the personal use or depreciation on the plane, which does not vary based on use. |

(C)

| Amounts represent the value of Ms. Ackermann’s personal use of BHC company vehicles prior to the B+L IPO and B+L company vehicles from the time of the B+L IPO through the end of the year. |

(D)

| Mr. Appio was previously on an expatriate assignment from New Jersey to China which ended on December 31, 2021; however, due to the continued COVID related lockdowns in China, BHCthe Company continued to maintain Mr. Appio’s residence in China and accordingly, Mr. Appio was liable for taxes in China.through February 2023. This amount represents the costs associated with maintaining Mr. Appio’s residence in China and the local taxes paidChina. The Company no longer maintains a residence for Mr. Appio in China. |

(E)(C)

| This amount represents the reimbursement related to the taxes on the imputed income from Mr. Appio’s Expat Program Benefits as provided for pursuant to BHC’sthe Company’s standard policy. |

(F)(D)

| Amounts reflect legal feesThis amount represents the value of the executive physical benefit provided to Mr. Papa in connection with the negotiation and execution of the Papa Separation Agreement.Company’s executives. |

(G)(7)

| Amounts represent severance received by Mr. Spurr in connection with his termination of employment by BHC without cause due to BHC’s elimination of the position of President, U.S. Businesses on June 1, 2022. For additional information, see the description of the Spurr Separation Agreement, set forth on page 54, and the “Potential Payments Upon Termination or Change in Control,” beginning on page 66. |

(6)

| Ms. Carson is paid in Canadian Dollars.Dollars (CAD). For purposes of this table, amounts have been converted from CAD to U.S. Dollars (USD) by using the exchange rate of .7618,0.74, which was the rate being used by the Company on December 31, 2022.2023. |

(7)(8)

| Mr. Spurr’s employment was terminated on June 10, 2022. |

(8)

| InVadaketh resigned from his position effective October 13, 2023 and did not receive any severance or other payments in connection with the B+L IPO, (i) Joseph C. Papa, our former Chairman of the Board and Chief Executive Officer, ceased serving in that role and became the Chairman and Chief Executive Officer of B+L, (ii) Sam A. Eldessouky, our former Executive Vice President and Chief Financial Officer, ceased serving in that role and became Executive Vice President and Chief Financial Officer of B+L, and (iii) Christina M. Ackermann, our former Executive Vice President, General Counsel and Head of Commercial Operations, ceased serving in that role and became Executive Vice President & General Counsel and President, Ophthalmic Pharmaceuticals of B+L.his resignation. |

60Bausch Health Companies Inc. | 56

| 2024 Proxy Statement |

TABLE OF CONTENTS Grants of Plan-Based Awards The following table provides information on the grants of plan-based awards to the NEOs during the year ended December 31, 2022.2023. Thomas J. Appio

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2022 BHC AIP | | | 2/14/2022 | | | 2/14/2022 | | | 0 | | | 1,200,000 | | | 2,400,000 | | | | | | | | | | | | | | | | | | | | | | 2022 BHC RSU | | | 3/2/2022 | | | 2/14/2022 | | | | | | | | | | | | | | | | | | | | | 152,690 | | | | | | | | | 3,690,517 | 2022 BHC Stock Options | | | 3/2/2022 | | | 2/14/2022 | | | | | | | | | | | | | | | | | | | | | | | | 565,330 | | | 24.17 | | | 3,748,138 | 2022 B+L Founder RSU | | | | | | | | | | | | | | | | | | | | | | | | | | | 55,555 | | | | | | | | | 999,990 | Tom G. Vadaketh

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2022 BHC AIP | | | 2/14/2022 | | | 2/14/2022 | | | 0 | | | 360,000 | | | 720,000 | | | | | | | | | | | | | | | | | | | | | | 2022 New Hire RSUs | | | 1/3/2022 | | | 10/20/2021 | | | | | | | | | | | | | | | | | | | | | 57,852 | | | | | | | | | 1,607,707 | 2022 New Hire Stock Options | | | 1/3/2022 | | | 10/20/2021 | | | | | | | | | | | | | | | | | | | | | | | | 227,669 | | | 23.16 | | | 1,500,339 | 2022 BHC RSU | | | 3/2/2022 | | | 2/14/2022 | | | | | | | | | | | | | | | | | | | | | 43,771 | | | | | | | | | 1,057,945 | 2022 BHC Stock Options | | | 3/2/2022 | | | 2/14/2022 | | | | | | | | | | | | | | | | | | | | | | | | 162,061 | | | 24.17 | | | 1,074,464 | 2022 BHC Retention RSU Grant | | | 9/5/2022 | | | 9/5/2022 | | | | | | | | | | | | | | | | | | | | | 374,891 | | | | | | | | | 2,418,047 | Seana Carson

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2022 BHC AIP | | | 2/14/2022 | | | 2/14/2022 | | | 0 | | | 303,954 | | | 607,908 | | | | | | | | | | | | | | | | | | | | | | 2022 BHC RSU | | | 3/2/2022 | | | 2/14/2022 | | | | | | | | | | | | | | | | | | | | | 33,591 | | | | | | | | | 811,895 | 2022 BHC Stock Options | | | 3/2/2022 | | | 2/14/2022 | | | | | | | | | | | | | | | | | | | | | | | | 124,372 | | | 24.17 | | | 824,586 | 2022 BHC Retention RSU Grant | | | 9/5/2022 | | | 9/5/2022 | | | | | | | | | | | | | | | | | | | | | 287,707 | | | | | | | | | 1,855,710 | Robert A. Spurr

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2022 BHC AIP | | | 2/14/2022 | | | 2/4/2022 | | | 0 | | | 560,000 | | | 1,120,000 | | | | | | | | | | | | | | | | | | | | | | 2022 BHC RSU | | | 3/2/2022 | | | 2/14/2022 | | | | | | | | | | | | | | | | | | | | | 35,627 | | | | | | | | | 861,105 | 2022 BHC Stock Options | | | 3/2/2022 | | | 2/14/2022 | | | | | | | | | | | | | | | | | | | | | | | | 131,910 | | | 24.17 | | | 874,563 | Joseph C. Papa

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2022 B+L AIP | | | 2/14/2022 | | | 2/14/2022 | | | 0 | | | 2,400,000 | | | 4,800,000 | | | | | | | | | | | | | | | | | | | | | | 2022 B+L Founder RSU | | | 5/5/2022 | | | 5/5/2022 | | | | | | | | | | | | | | | | | | | | | 472,222 | | | | | | | | | 8,499,996 | 2022 B+L Founder Stock Options | | | 5/5/2022 | | | 5/5/2022 | | | | | | | | | | | | | | | | | | | | | | | | 1,868,131 | | | 18.00 | | | 8,499,996 | Sam A. Eldessouky

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2022 B+L AIP | | | 2/14/2022 | | | 2/14/2022 | | | 0 | | | 560,000 | | | 1,120,000 | | | | | | | | | | | | | | | | | | | | | | 2022 B+L Founder RSU | | | 5/5/2022 | | | 5/5/2022 | | | | | | | | | | | | | | | | | | | | | 125,000 | | | | | | | | | 2,250,000 | 2022 B+L Founder Stock Options | | | 5/5/2022 | | | 5/5/2022 | | | | | | | | | | | | | | | | | | | | | | | | 494,505 | | | 18.00 | | | 2,249,998 | 2022 B+L Retention RSU Grant | | | 7/25/2022 | | | 7/25/2022 | | | | | | | | | | | | | | | | | | | | | 35,000 | | | | | | | | | 563,150 | Christina M. Ackermann

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2022 B+L AIP | | | 2/14/2022 | | | 2/14/2022 | | | 0 | | | 600,000 | | | 1,200,000 | | | | | | | | | | | | | | | | | | | | | | 2022 Founder RSU | | | 5/5/2022 | | | 5/5/2022 | | | | | | | | | | | | | | | | | | | | | 83,333 | | | | | | | | | 1,499,994 | 2022 B+L Founder Stock Options | | | 5/5/2022 | | | 5/5/2022 | | | | | | | | | | | | | | | | | | | | | | | | 329,670 | | | 18.00 | | | 1,499,999 | 2022 B+L Retention RSU Grant | | | 7/25/2022 | | | 7/25/2022 | | | | | | | | | | | | | | | | | | | | | 35,000 | | | | | | | | | 563,150 |

TABLE OF CONTENTS

| | Thomas J. Appio | | | | 2023 AIP | | | 2/9/2023 | | | 2/9/2023 | | | 0 | | | 1,500,000 | | | 3,000,000 | | | | | | | | | | | | | | | | | | | | | | | | | 2023 RSU | | | 3/2/2023 | | | 2/9/2023 | | | | | | | | | | | | | | | | | | | | | 523,155 | | | | | | | | | 4,839,184 | | | | 2023 PSU | | | 3/2/2023 | | | 2/9/2023 | | | | | | | | | | | | 294,275 | | | 784,733 | | | 1,569,466 | | | | | | | | | | | | 8,294,628 | | | | John S. Barresi

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2023 AIP | | | 2/9/2023 | | | 2/9/2023 | | | 0 | | | 235,107 | | | 470,214 | | | | | | | | | | | | | | | | | | | | | | | | | 2023 RSU | | | 3/2/2023 | | | 2/9/2023 | | | | | | | | | | | | | | | | | | | | | 25,266 | | | | | | | | | 233,711 | | | | 2023 PSU | | | 3/2/2023 | | | 2/9/2023 | | | | | | | | | | | | 9,475 | | | 25,266 | | | 50,532 | | | | | | | | | | | | 267,062 | | | | 2023 Stock Options | | | 3/2/2023 | | | 2/9/2023 | | | | | | | | | | | | | | | | | | | | | | | | 21,812 | | | 9.25 | | | 106,224 | | | | Seana Carson

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2023 AIP | | | 2/9/2023 | | | 2/9/2023 | | | 0 | | | 323,632 | | | 647,264 | | | | | | | | | | | | | | | | | | | | | | | | | 2023 RSU | | | 3/2/2023 | | | 2/9/2023 | | | | | | | | | | | | | | | | | | | | | 95,119 | | | | | | | | | 879,851 | | | | 2023 PSU | | | 3/2/2023 | | | 2/9/2023 | | | | | | | | | | | | 35,670 | | | 95,119 | | | 190,238 | | | | | | | | | | | | 1,005,408 | | | | 2023 Stock Options | | | 3/2/2023 | | | 2/9/2023 | | | | | | | | | | | | | | | | | | | | | | | | 82,117 | | | 9.25 | | | 399,910 | | | | Tom G. Vadaketh

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2023 AIP | | | 2/9/2023 | | | 2/9/2023 | | | 0 | | | 405,000 | | | 810,000 | | | | | | | | | | | | | | | | | | | | | | | | | 2023 RSU | | | 3/2/2023 | | | 2/9/2023 | | | | | | | | | | | | | | | | | | | | | 142,678 | | | | | | | | | 1,319,772 | | | | 2023 PSU | | | 3/2/2023 | | | 2/9/2023 | | | | | | | | | | | | 53,504 | | | 142,678 | | | 285,356 | | | | | | | | | | | | 1,508,106 | | | | 2023 Stock Options | | | 3/2/2023 | | | 2/9/2023 | | | | | | | | | | | | | | | | | | | | | | | | 123,177 | | | 9.25 | | | 599,872 | |

(1)

| The 2022 BHC2023 AIP and the 2022 B+L AIP representrepresents the threshold, target, and maximum awards provided for under the applicable annual incentive programs.2023 AIP. Mr. Vadaketh was not eligible for a payout under the 2023 AIP. The actual amount paid for 20222023 is included in the Summary Compensation Table on page 5955 under the column titled “Non-Equity Incentive Plan Compensation.” |

(2)

| (2)Amounts shown are the threshold, target and maximum number of units that can be distributed under the 2023 PSUs awarded, based on the extent to which the financial metrics (Adjusted Operating Cash Flow and rTSR) are achieved under these awards as further described in the section titled “2023 PSUs” beginning on page 48. Earned PSUs, if any, can range from 0% to 200% of target. |

(3)

| This column shows the number of RSUs granted in 2022.2023. The 2022 BHC2023 RSUs the 2022 BHC Retention RSU Grant, Mr. Vadaketh’s New Hire RSU grant and the B+L Retention RSU Grant all vest in three equal installments on the first, second and third anniversaries of the grant date assuming continued employment through the applicable vesting dates. The B+L Founder RSUs vest 50% each on the second and third anniversary of the grant date or, if later, the earlier of the full separation from BHC or a change in control of B+L subject to the applicable NEO’s continued employment through the applicable vesting dates. |

(3)(4)

| This column shows the number of Stock Options granted in 2022.2023. The 2022 BHC Stock Options, Mr. Vadaketh’s New Hire Options and the B+L Founder2023 Stock Options vest in three equal installments on the first, second and third anniversaries of the grant date, subject to continued employment through the applicable vesting date. Each Stock Option will remain exercisable until the ten-year anniversary of the grant date. The aggregate number of Stock Options granted by BHC in 20222023 expressed as a percentage of the total issued and outstanding shares of BHC as of December 31, 20222023 (otherwise known as the “burn rate”) was .71%0.27%. |

(4)(5)

| The exercise price of the 2022 BHC Stock Options and Mr. Vadaketh’s New Hire2023 Stock Options is the closing price of the Common Shares on the grant date. The exercise price of the B+L Founder Stock Options is the IPO price of B+L’s common shares. |

(5)(6)

| ThisThe amounts reflected in this column showsrepresent the aggregate grant date fair value of eachthe Company equity awardawards granted to the NEOs in 2023, computed in accordance with FASB ASC Topic 718. The grant date fair value718 (excluding the effect of theestimated forfeitures) and, for Stock Options, was determined using Black-Scholes. For PSUs, the grant date fair value is based on the probable outcome of the performance conditions as of the grant date, consistent with the estimate of aggregate compensation cost to be recognized over the service period determined as of the grant date under FASB ASC Subtopic 718-10. The grant date fair values reflected in this column may differ from the approved values reflected in the CD&A because of the accounting methodology used to report the PSUs in this column, as required by SEC rules. |

62Bausch Health Companies Inc. | 57

| 2024 Proxy Statement |

TABLE OF CONTENTS Outstanding Equity Awards at Fiscal Year-End The following table provides information on outstanding BHC and B+L Equity Awards held by the NEOs as of December 30, 2022.31, 2023. The market value of the equity awards, other than for Mr. Appio’s May 5, 2022 B+L Founders’ RSU, is based on the closing market prices on December 30, 2022, which was $6.28 forprice of our Common Shares and $15.51on December 29, 2023 which was $8.02. The market value for Mr. Appio’s B+L. L Founders’ RSU is based on the closing price of B+L’s Common Shares on December 29, 2023 which was $17.06.

Thomas J. Appio

| | | BHC

| | | 8/9/2013

| | | 22,350(1)

| | | | | | 101.68

| | | 8/9/2023

| | | | | | | | | | | | | | | BHCThomas J. Appio

| | | 3/1/2017 | | | 30,174(1) | | | | | | 14.38 | | | 3/1/2027 | | | | | | | | | | | | | | | | | BHC

| | | 3/7/2018 | | | 65,923(1) | | | | | | 15.32 | | | 3/7/2028 | | | | | | | | | | | | | | | BHC

| | | | 2/27/2019 | | | 62,004(1) | | | | | | 23.16 | | | 2/27/2029 | | | | | | | | | | | | | | | BHC

| | | | 2/26/2020 | | | 54,58281,873(1)

| | | 27,291(1)

| | | 24.77 | | | 2/26/2030 | | | | | | | | | | | | | | | | BHC3/3/2021

| | | 31,434(1) | | | 15,717(1) | | | 32.56 | | | 3/3/2031 | | | | | | | | | | | | | | | | 3/3/2021 | | | | | | | | | | | | | | | 4,944(2) | | | 39,651 | | | | | | | | | | 3/3/2021 | | | | | | | | | | | | | | | 5,932(2) | | | 47,575 | | | | | | | | | | 9/1/2021 | | | | | | | | | | | | | | | 30,087(2) | | | 241,298 | | | | | | | | | | 3/2/26/20202022 | | | 188,443(1) | | | 376,887(1) | | | 24.17 | | | 3/2/2032 | | | | | | | | | | | | | | | | 3/2/2022 | | | | | | | | | | | | | | | 101,794(2) | | | 816,388 | | | | | | | | | | 5/5/2022 | | | | | | | | | | | | | | | 55,555(3) | | | 947,768 | | | | | | | | | | 3/2/2023 | | | | | | | | | | | | | | | 6,483523,155(2)

| | | 40,7134,195,703

| | | | | | | | | BHC

| | | 2/26/2020

| | | | | | | | | | | | | | | 12,447(3)

| | | 78,167

| | | | | | | | | BHC

| | | 3/3/2021 | | | 15,717(1)

| | | 31,434(1)

| | | 32.56

| | | 3/3/20312/2023

| | | | | | | | | | | | | | | | | | | | | 865,822(4) | | | 6,943,892 | | | | BHCJohn S. Barresi

| | | 6/20/2022 | | | | | | | | | | | | | | | 11,266(2) | | | 90,353 | | | | | | | | | | 9/5/2022 | | | | | | | | | | | | | | | 23,249(2) | | | 186,457 | | | | | | | | | | 3/2/2023 | | | | | | 21,812(1) | | | 9.25 | | | 3/3/20212/2033 | | | | | | | | | | | | | | | | 3/2/2023 | | | | | | | | | | | | | | | 12,69425,266(3)(2)

| | | 79,718202,633

| | | | | | | | | | BHC3/2/2023

| | | 3/3/2021

| | | | | | | | | | | | | | | | | | 6,88127,877(3)(4)

| | | 43,213223,574

| | | | Seana Carson | | | 6/9/2016 | | | 3,996(1) | | | | | | 23.92 | | | 6/9/2026 | | | | | | | | | | | | | | | | 2/27/2019 | | | 4,246(1) | | | | | | 23.16 | | | 2/27/2029 | | | | | | | | | | | | | | | | 2/26/2020 | | | 18,115(1) | | | | | | 24.77 | | | 2/26/2030 | | | | | | | | | | | | | | | | 3/3/2021 | | | 7,573(1) | | | 3,787(1) | | | 32.56 | | | 3/3/2031 | | | | | | | | | | | | | | | | 3/3/2021 | | | | | | | | | | | | | | | 953(2) | | | 7,643 | | | | | | | | | | 3/3/2021 | | | | | | | | | | | | | | | 1,429(2) | | | 11,461 | | | | | | | | | | 12/1/2021 | | | | | | | | | | | | | | | 3,159(2) | | | 25,335 | | | | | | | | | | 3/2/2022 | | | 41,457(1) | | | 82,915(1) | | | 24.17 | | | 3/2/2032 | | | | | | | | | | | | | | | | 3/2/2022 | | | | | | | | | | | | | | | 22,394(2) | | | 179,600 | | | | | | | | | | 9/5/2022 | | | | | | | | | | | | | | | 191,805(2) | | | 1,538,276 | | | | | | | | | | 3/2/2023 | | | | | | 82,117(1) | | | 9.25 | | | 3/2/2033 | | | | | | | | | | BHC

| | | 3/3/2021

| | | | | | | | | | | | | | | 11,864(2)

| | | 74,506

| | | | | | | | | BHC

| | | 3/3/20212/2023 | | | | | | | | | | | | | | | 9,88795,119(2)

| | | 62,090762,854

| | | | | | | | | BHC

| | | 9/1/2021

| | | | | | | | | | | | | | | | | | | | | 45,130(4)

| | | 283,416

| | | BHC

| | | 9/1/20213/2/2023

| | | | | | | | | | | | | | | 60,174(2)

| | | 377,893

| | | | | | | | BHC

| | | 3/2/2022

| | | 0104,948(1)(4)

| | | 565,330(1)841,683

| | | 24.17

| | | 3/2/2032

| | | | | | | | | | | | | | | BHC

| | | 3/2/2022

| | | | | | | | | | | | | | | 152,690(2)

| | | 958,893

| | | | | | | | B+L

| | | 5/5/2022

| | | | | | | | | | | | | | | 55,555

| | | 861,658(5)

| | | | | | | Tom G. Vadaketh | | | BHC

| | | 1/3/2022

| | | | | | | | | | | | | | | 57,852(2)(5)

| | | 363,311

| | | | | | | | BHC

| | | 2/24/2022 | | | 075,889(1)

| | | 227,669(1)

| | | 23.16 | | | 2/24/2032 | | | | | | | | | | | | | | | BHC

| | | | 3/2/2022 | | | 054,020(1)

| | | 162,061(1)

| | | 24.17

| | | 3/2/2032

| | | | | | | | | | | | | | BHC

| | | 3/2/2022

| | | | | | | | | | | | | | | 43,771(2)

| | | 274,882

| | | | | | | | BHC

| | | 9/5/2022

| | | | | | | | | | | | | | | 374,891(2)

| | | 2,354,315

| | | | | | | Seana Carson

| | | BHC

| | | 11/11/2013

| | | 21,492(1)

| | | | | | 105.44

| | | 11/11/2023

| | | | | | | | | | | | | | BHC

| | | 6/9/2016

| | | 3,996(1)

| | | | | | 23.92

| | | 6/9/2026

| | | | | | | | | | | | | | BHC

| | | 2/27/2019

| | | 4,246(1)

| | | | | | 23.16

| | | 2/27/2029

| | | | | | | | | | | | | | BHC

| | | 2/26/2020

| | | 12,076(1)

| | | 6,039(1)

| | | 24.77

| | | 2/26/2030

| | | | | | | | | | | | | | BHC

| | | 2/26/2020

| | | | | | | | | | | | | | | 1,434(2)

| | | 9,006

| | | | | | | | BHC

| | | 2/26/2020

| | | | | | | | | | | | | | | 2,752(3)

| | | 17,283

| | | | | | | | BHC

| | | 3/3/2021

| | | 3,786(1)

| | | 7,574(1)

| | | 32.56

| | | 3/3/2031

| | | | | | | | | | | | | | BHC

| | | 3/3/2021

| | | | | | | | | | | | | | | 3,058(3)

| | | 19,204

| | | | | | | | BHC

| | | 3/3/2021

| | | | | | | | | | | | | | | 1,657(3)

| | | 10,406

| | | | | | | | BHC

| | | 3/3/2021

| | | | | | | | | | | | | | | 2,858(2)

| | | 17,948

| | | | | | | | BHC

| | | 3/3/2021

| | | | | | | | | | | | | | | 1,906(2)

| | | 11,970

| | | | | | | | BHC

| | | 11/3/2021

| | | | | | | | | | | | | | | 623(2)

| | | 3,912

| | | | | | | | BHC

| | | 12/1/2021

| | | | | | | | | | | | | | | 6,317(2)

| | | 39,671

| | | | | | | | BHC

| | | 3/2/2022

| | | 0(1)

| | | 124,372(1)

| | | 24.17 | | | 3/2/2032 | | | | | | | | | | | | | | | BHC

| | | 3/2/2022

| | | | | | | | | | | | | | | 33,591(2)

| | | 210,951

| | | | | | | | BHC

| | | 9/5/2022

| | | | | | | | | | | | | | | 287,707(2)

| | | 1,806,800

| | | | | | |

TABLE OF CONTENTS

Joseph C. Papa | | | BHC | | | 6/9/2016 | | | 682,652(1) | | | — | | | 23.92 | | | 5/2/2026 | | | | | | | | | | | | | | | BHC | | | 3/7/2018 | | | 338,058(1) | | | — | | | 15.32 | | | 3/7/2028 | | | | | | | | | | | | | | | BHC | | | 2/27/2019 | | | 236,183(1) | | | — | | | 23.16 | | | 2/27/2029 | | | | | | | | | | | | | | | BHC | | | 2/26/2020 | | | 227,409(1) | | | 113,705(1) | | | 24.77 | | | 2/26/2030 | | | | | | | | | | | | | | | BHC | | | 2/26/2020 | | | | | | | | | | | | | | | 27,014(2) | | | 169,648 | | | | | | | | | BHC | | | 2/26/2020 | | | | | | | | | | | | | | | 116,697(3) | | | 732,857 | | | | | | | | | BHC | | | 3/3/2021 | | | 65,488(1) | | | 130,796(1) | | | 32.56 | | | 3/3/2031 | | | | | | | | | | | | | | | BHC | | | 3/3/2021 | | | | | | | | | | | | | | | 49,434(2) | | | 310,446 | | | | | | | | | BHC | | | 3/3/2021 | | | | | | | | | | | | | | | 119,011(3) | | | 747,389 | | | | | | | | | BHC | | | 3/3/2021 | | | | | | | | | | | | | | | 64,511(3) | | | 405,129 | | | | | | | | | BHC | | | 3/3/2021 | | | | | | | | | | | | | | | | | | | | | 65,912(6) | | | 413,927 | | | B+L | | | 5/5/2022 | | | | | | | | | | | | | | | 472,222(5) | | | 7,324,163 | | | | | | | | | B+L | | | 5/5/2022 | | | (7) | | | 1,868,131(7) | | | 18.00 | | | 5/5/2032 | | | | | | | | | | | | | Sam A. Eldessouky | | | BHC | | | 3/1/2017 | | | 31,430(1) | | | — | | | 14.38 | | | 3/1/2027 | | | | | | | | | | | | | | | BHC | | | 3/7/2018 | | | 31,697(1) | | | — | | | 15.32 | | | 3/7/2028 | | | | | | | | | | | | | | | BHC | | | 2/27/2019 | | | 22,149(1) | | | — | | | 23.16 | | | 2/27/2029 | | | | | | | | | | | | | | | BHC | | | 2/26/2020 | | | 18,952(1) | | | 9,477(1) | | | 24.77 | | | 2/26/2030 | | | | | | | | | | | | | | | BHC | | | 2/26/2020 | | | | | | | | | | | | | | | 2,251(2) | | | 14,136 | | | | | | | | | BHC | | | 2/26/2020 | | | | | | | | | | | | | | | 4,321(3) | | | 27,136 | | | | | | | | | BHC | | | 3/3/2021 | | | 5,458(1) | | | 10,916(1) | | | 32.56 | | | 3/3/2031 | | | | | | | | | | | | | | | BHC | | | 3/3/2021 | | | | | | | | | | | | | | | 4,120(2) | | | 25,874 | | | | | | | | | BHC | | | 3/3/2021 | | | | | | | | | | | | | | | 2,746(2) | | | 17,245 | | | | | | | | | BHC | | | 3/3/2021 | | | | | | | | | | | | | | | 4,407(3) | | | 27,676 | | | | | | | | | BHC | | | 3/3/2021 | | | | | | | | | | | | | | | 2,389(3) | | | 15,003 | | | | | | | | | BHC | | | 6/1/2021 | | | 40,809(1) | | | 81,618(1) | | | 32.03 | | | 6/1/2031 | | | | | | | | | | | | | | | BHC | | | 6/1/2021 | | | | | | | | | | | | | | | 22,449(2) | | | 140,980 | | | | | | | | | B+L | | | 5/5/2022 | | | (7) | | | 494,505(7) | | | 18.00 | | | 5/5/2032 | | | | | | | | | | | | | | | B+L | | | 5/5/2022 | | | | | | | | | | | | | | | 125,000(5) | | | 1,938,750 | | | | | | | | | B+L | | | 7/25/2022 | | | | | | | | | | | | | | | 35,000(8) | | | 542,850 | | | | | | | Christina M. Ackermann | | | BHC | | | 8/10/2016 | | | 39,469(1) | | | — | | | 27.32 | | | 8/10/2026 | | | | | | | | | | | | | | | BHC | | | 2/27/2019 | | | 62,004(1) | | | — | | | 23.16 | | | 2/27/2029 | | | | | | | | | | | | | | | BHC | | | 2/26/2020 | | | 54,582(1) | | | 27,291 | | | 24.77 | | | 2/26/2030 | | | | | | | | | | | | | | | BHC | | | 2/26/2020 | | | | | | | | | | | | | | | 6,483(2) | | | 40,713 | | | | | | | | | BHC | | | 2/26/2020 | | | | | | | | | | | | | | | 12,447(3) | | | 78,167 | | | | | | | | | BHC | | | 3/10/2020 | | | | | | | | | | | | | | | 1,464(2) | | | 9,194 | | | | | | | | | BHC | | | 8/28/2020 | | | | | | | | | | | | | | | 9,391(2) | | | 58,975 | | | | | | | | | BHC | | | 3/3/2021 | | | 17,464(1) | | | 34,928(1) | | | 32.56 | | | 3/3/2031 | | | | | | | | | | | | | | | BHC | | | 3/3/2021 | | | | | | | | | | | | | | | 13,182(2) | | | 82,783 | | | | | | | | | BHC | | | 3/3/2021 | | | | | | | | | | | | | | | 10,985(2) | | | 68,986 | | | | | | | | | BHC | | | 3/3/2021 | | | | | | | | | | | | | | | 14,104(3) | | | 88,573 | | | | | | | | | BHC | | | 3/3/2021 | | | | | | | | | | | | | | | 7,645(3) | | | 48,011 | | | | | | | | | B+L | | | 5/5/2022 | | | (7) | | | 329,670(7) | | | 18.00 | | | 5/5/2032 | | | | | | | | | | | | | | | B+L | | | 5/5/2022 | | | | | | | | | | | | | | | 83,333(5) | | | 1,292,495 | | | | | | | | | B+L | | | 7/25/2022 | | | | | | | | | | | | | | | 35,000(8) | | | 542,850 | | | | | | |

(1)

| BHC Stock Options vest in three equal installments on the first, second and third anniversaries of the grant date, subject to continued employment through the applicable vesting date. Each Stock Option will remain exercisable until the ten-year anniversary of the grant date. |

(2)Bausch Health Companies Inc.

| 58

| BHC 2024 Proxy Statement |

TABLE OF CONTENTS (2)

| RSUs vest in three equal installments on the first, second and third anniversaries of the grant date assuming continued employment through the applicable vesting date. |

(3)

| The amount reported reflects outstanding BHC PSUs granted in 2020 and 2021. In connection with theThis B+L IPO, the Talent and Compensation Committee determined to adjust the terms of the PSUs granted in 2020 to provide that ROTC performance in respect of the 2022 performance period will be deemed to be achieved at target as of the completion of the B+L IPO. In connection with this offering, the BHC Talent Compensation Committee determined to adjust the terms of the PSUs granted in 2021 to provide that ROTC performance in respect of the 2022 performance period and the 2023 performance period will be deemed to be achieved at target as of the completion of the B+L IPO. Further, in connection with the B+L IPO, the BHC Talent and Compensation Committee determined to adjust the terms |

TABLE OF CONTENTS

of the PSUs granted in each of 2020 and 2021 to provide that the last day of the TSR performance period applicable to such PSUs will be the date of the completion of the B+L IPO, with actual achievement of the TSR performance metrics measured by the Talent and Compensation Committee through such date. The 2020 and 2021 PSUs have since been distributed on February 27, 2023, and March 3, 2023, respectively.

(4)

| The amount reported is the threshold number of shares; the actual amount earned will be determined upon the earlier of (i) the second anniversary of the grant date or (ii) full separation of B+L from BHC. The amount of shares that can be earned under the award is based on the value equal to the sum of (x) the average closing price of the Common Shares for the 20 trading days preceding (and not including) the performance measurement date plus (y) the aggregate value of any dividends paid or declared on such Common Shares (excluding the distribution of common shares of B+L) over the performance period (the “Adjusted Share Price”). If the Adjusted Share Price equals or exceeds $27.70, 50% of target shares delivered; if the Adjusted Share Price equals or exceeds $30.47, 100% of target shares delivered; if the Adjusted Share Price equals or exceeds $31.86, 150% of target shares delivered; and if the Adjusted Share Price equals or exceeds $33.24, 200% of target shares delivered. |

(5)

| The B+L Founder RSUsFounders’ RSU will vest 50% on each of the second and third anniversaries of the grant date or, if later, the earlier of the full separation of B+L, or a change in control of B+L, subject to the NEO’sMr. Appio’s continued employment through the applicable closing date of the change in control.employment. |

(6)(4)

| The BHC Separation PSUs granted in 2023 are shown atearned and vest based on (i) the target number of shares. These BHC Separation PSUs will be earned upon the consummationaverage annual achievement of the spin-off distribution of B+LAdjusted Operating Cash Flow performance goal measured over three individual one-year periods, from BHC. The number of PSUs that may be achieved is capped at 100%. The Separation PSUs will generally vest2023 through 2025 and then averaged together, and (ii) an rTSR modifier determined based on the date the performance metric is achieved (or otherwise certified by BHC’s Talent and Compensation Committee, if applicable). Under the Papa Separation Agreement, these Separation PSUs will fully vest in accordance with the treatmentCompany’s TSR relative to that of the grant termsTSR Peer Group over the cumulative three-year period 2023 through 2025. The amounts included in the table above reflect (a) the actual level of achievement of the Adjusted Operating Cash Flow performance goal for a termination by B+L without causethe first measurement period (2023) applicable to these PSUs and have since been distributed on March 6, 2023.(b) assumed target achievement of the Adjusted Operating Cash Flow performance goal and the rTSR modifier goal for the remaining performance periods. |

(7)(5)

| The B+L FounderUpon Mr. Vadaketh’s termination on October 13, 2023, all of his unvested Stock Options will vest ratably onwere cancelled. The amount reported represents the first three anniversariesportion of the grant date, or, if later, upon the full separation of B+L from BHC or a change in control of B+L, subject to continued employment through the applicable vesting date. The B+L Founderhis Stock Options will remain exercisable untilthat were vested at the ten-year anniversarytime of the grant date. |

(8)

| his termination. Pursuant to his Stock Option award agreements, any vested Stock Options that were not exercised within three months of Mr. Vadaketh’s termination would expire and cancel on January 13, 2024. The B+L RetentionStock Options reported expired and were cancelled on January 13, 2024. Mr. Vadaketh’s PSU and RSU Grants vestgrants were forfeited in three equal installments on the first, second and third anniversaries of the grant date, assuming continued employmentconnection with B+L through each applicable date.his departure. |

Option Exercises and Stock Vested The following table provides information regarding option exercises by the NEOs during 2022,2023, and Common Shares of BHC acquired on the vesting of RSUs held by the NEOs during 2022.2023. Thomas J. Appio | | | — | | | — | | | 78,840 | | | 1,377,379 | Tom G. Vadaketh | | | — | | | — | | | — | | | — | Seana Carson | | | — | | | — | | | 14,042 | | | 276,428 | Robert A. Spurr | | | — | | | — | | | 52,356 | | | 947,325 | Joseph C. Papa | | | — | | | — | | | 370,015 | | | 7,882,966 | Sam A. Eldessouky | | | — | | | — | | | 28,118 | | | 516,243 | Christina M. Ackermann | | | | | | | | | 60,815 | | | 1,289,279 |

| | Thomas J. Appio | | | — | | | — | | | 130,363 | | | 1,185,406 | | | | John S. Barresi | | | — | | | — | | | 17,256 | | | 138,737 | | | | Seana Carson | | | — | | | — | | | 122,163 | | | 1,037,381 | | | | Tom G. Vadaketh | | | — | | | — | | | 158,837 | | | 1,299,502 | |

(1)

| The amounts reflected in this column represent the market value of the underlying Common Shares as of the vesting date. |

65Bausch Health Companies Inc. | 59

| 2024 Proxy Statement |

TABLE OF CONTENTS POTENTIAL PAYMENTS UPON TERMINATION OR CHANGE IN CONTROL The following table sets forth the expected benefits to be received by each of our NEOs in each of the following termination scenarios (except for Mr. Spurr,Vadaketh, who experienced a termination of employment on June 10, 2022)October 13, 2023 and was not eligible to receive severance). This table assumes a termination date of December 31, 2022.2023. The value attributed to equity awards is based on the closing market pricesprice on December 30, 2022,29, 2023, which was $6.28 for of our Common Shares and $15.51 for B+L. With respect to a termination of employment without “cause” or a resignation for “good reason,” the receipt of benefits is generally subject to executing and not revoking a release of claims. Other relevant assumptions and explanations are set forth in the footnotes following the table. Thomas J. Appio

| | | | | | | | | | | | | Cash(1) | | | 5,448,000 | | | 5,600,000 | | | — | | | — | BHC RSUs(2) | | | 555,202 | | | 1,514,095 | | | 1,514,095 | | | 555,202 | BHC PSUs(3)(4) | | | 254,426 | | | 254,426 | | | 254,426 | | | 254,426 | BHC Stock Options(5) | | | — | | | — | | | — | | | — | B+L RSUs(6) | | | — | | | 861,658 | | | 861,658 | | | — | Other Benefits(1) | | | 22,801 | | | 22,801 | | | — | | | — | Total Estimated Incremental Value | | | 6,280,429 | | | 8,252,980 | | | 2,630,179 | | | 809,628 | | | | | | | | | | | | | | Tom G. Vadaketh

| | | | | | | | | | | | | Cash(7) | | | 1,679,472 | | | 2,280,000 | | | 360,000 | | | — | BHC RSUs(2) | | | — | | | 2,992,508 | | | 2,992,508 | | | — | BHC Stock Options(5) | | | — | | | — | | | — | | | — | Other Benefits(7) | | | 22,920 | | | 22,920 | | | — | | | — | Total Estimated Incremental Value | | | 1,702,392 | | | 5,295,428 | | | 3,352,508 | | | — | | | | | | | | | | | | | | Seana Carson

| | | | | | | | | | | | | Cash(8) | | | 1,468,006 | | | 1,925,042 | | | — | | | — | BHC RSUs(2) | | | 36,317 | | | 2,100,258 | | | 2,100,258 | | | — | BHC PSUs(3) | | | 37,014 | | | 37,014 | | | 37,014 | | | | BHC Stock Options(5) | | | — | | | — | | | — | | | — | Other Benefits(8) | | | 3,782 | | | 3,782 | | | — | | | — | Total Estimated Incremental Value | | | 1,545,119 | | | 4,066,096 | | | 2,137,272 | | | — | | | | | | | | | | | | | | Joseph C. Papa

| | | | | | | | | | | | | Cash(9) | | | 10,328,000 | | | 10,328,000 | | | 1,128,000 | | | — | B+L RSUs(10) | | | 4,894,832 | | | 7,324,163 | | | 7,324,163 | | | — | B+L Stock Options(10) | | | — | | | — | | | — | | | — | BHC RSUs(11) | | | 1,914,779 | | | 1,914,779 | | | 1,500,851 | | | 1,500,851 | BHC PSUs(11) | | | 480,093 | | | 480,093 | | | 480,093 | | | 480,093 | BHC Stock Options(11) | | | — | | | — | | | — | | | — | Other Benefits(12) | | | 37,763 | | | 37,763 | | | — | | | — | Total Estimated Incremental Value

| | | 17,655,467 | | | 20,084,798 | | | 10,433,107 | | | 1,980,944 | | | | | | | | | | | | | | Sam A. Eldessouky

| | | | | | | | | | | | | Cash(13) | | | 3,145,200 | | | 3,330,000 | | | — | | | — | B+L RSUs(14) | | | 967,394 | | | 2,481,600 | | | 2,481,600 | | | — | B+L Stock Options(14) | | | — | | | — | | | — | | | — | BHC RSUs(15) | | | 129,993 | | | 198,234 | | | 198,234 | | | — | BHC PSUs(15) | | | 55,575 | | | 55,575 | | | 55,575 | | | | BHC Stock Options(15) | | | — | | | — | | | — | | | — | Other Benefits(16) | | | 42,775 | | | 42,775 | | | — | | | — | Total Estimated Incremental Value | | | 4,340,937 | | | 6,108,184 | | | 2,735,409 | | | — | | | | | | | | | | | | | | Christina M. Ackermann

| | | | | | | | | | | | | Cash(13) | | | 3,352,000 | | | 3,550,000 | | | — | | | — | B+L RSUs(14) | | | 825,878 | | | 1,835,345 | | | 1,835,345 | | | — |

TABLE OF CONTENTS

B+L Stock Options(14) | | | — | | | — | | | — | | | — | BHC RSUs(15) | | | 187,997 | | | 260,651 | | | 260,651 | | | — | BHC PSUs(15) | | | 169,181 | | | 169,181 | | | 169,181 | | | | BHC Stock Options(15) | | | — | | | — | | | — | | | — | Other Benefits(16) | | | 48,110 | | | 48,110 | | | — | | | — | Total Estimated Incremental Value | | | 4,583,166 | | | 5,863,287 | | | 2,265,177 | | | — |

| | Thomas J. Appio

| | | | | | | | | | | | | | | | Cash(1) | | | 7,150,000 | | | 7,150,000 | | | — | | | — | | | | RSUs(2) | | | 832,352 | | | 5,340,615 | | | 5,340,615 | | | 1,144,912 | | | | PSUs(3) | | | — | | | 2,092,105 | | | 2,308,289 | | | — | | | | Stock Options(4) | | | — | | | — | | | — | | | — | | | | B+L Founder’s RSU(5) | | | 523,175 | | | 947,768 | | | 947,768 | | | — | | | | Other Benefits(1) | | | 25,412 | | | 25,412 | | | — | | | — | | | | Total Estimated Incremental Value | | | 8,530,939 | | | 15,555,900 | | | 8,596,672 | | | 1,144,912 | | | | John S. Barresi | | | | | | | | | | | | | | | | Cash(6) | | | 1,280,337 | | | 1,629,520 | | | — | | | — | | | | RSUs(7) | | | 107,792 | | | 479,443 | | | 479,443 | | | — | | | | PSUs(8) | | | — | | | — | | | 74,320 | | | — | | | | Stock Options(9) | | | — | | | — | | | — | | | — | | | | Other Benefits(6) | | | 37,016 | | | 37,016 | | | — | | | — | | | | Total Estimated Incremental Value | | | 1,425,145 | | | 2,145,979 | | | 553,763 | | | — | | | | Seana Carson

| | | | | | | | | | | | | | | | Cash(10) | | | 1,668,159 | | | 2,099,668 | | | — | | | — | | | | RSUs(2) | | | 660,617 | | | 2,525,169 | | | 2,525,169 | | | — | | | | PSUs(3) | | | — | | | 253,588 | | | 279,792 | | | — | | | | Stock Options(4) | | | — | | | — | | | — | | | — | | | | Other Benefits(10) | | | 4,078 | | | 4,078 | | | — | | | — | | | | Total Estimated Incremental Value | | | 2,332,854 | | | 4,882,503 | | | 2,804,961 | | | — | |

(1)

| If Mr. Appio’s employment is terminated by us without “cause”, or by Mr. Appio for “good reason” (in each case as defined in the Appio Agreement), including within 12 months of a change in control (or during the six-month period prior to a change in control if such termination was in contemplation of, and directly related to, the change in control), or upon the expiration of his employment term, Mr. Appio will be entitled to receive a cash severance payment equal to the sum of two times the sum of his annual base salary and annual target incentive payable in a lump sum, and a prorated annual incentive for the year of termination equal to the lesser of the annual incentive based on our actual performance and annual target incentive, provided that if such termination occurs in contemplation of a change in control or within twelve months following a change in control then the amount will be based on Mr. Appio’s annual target incentive, and a cash payment equal to the remaining 50% of the B+L separation bonus, as shown above in “Cash” under “Termination without Cause or for Good Reason” and “Termination within 12 months of a Change in Control.” Mr. Appio will also be entitled to receive continued health benefits for two years at active employee rates, as shown above in “Other Benefits” under “Termination without Cause or for Good Reason” and “Termination within 12 months of a Change in Control.” |

(2)

| Pursuant to the terms of the equity award agreements governing Mr. Appio and Ms. Carson’s 2020, 2021, 2022 and 2022 BHC RSUs, and Mr. Vadaketh’s 2022 BHC2023 RSUs, if Mr. Appio’s, or Ms. Carson’s or Mr. Vadaketh’s employment is terminated by usthe Company without “cause” or by themthe NEO for “good reason” (in each case as defined under the Appio Agreement, Carson Agreement and Vadakeththe Carson Agreement, respectively), unvested RSUs will vest pro-rata and, if their employment is terminated due to death or disability, all unvested RSUs will vest. Under these agreements, if they are terminated without cause or resign for good reason within 12 months of a change in control (or during the six-month period prior to a change in control if such termination was in contemplation of, and directly related to, the change in control), all unvested RSUs will vest. This vesting treatment applies beginning after the first anniversary of the grant date if they experience a termination of employment by BHCthe Company without cause or by the NEO for good reason. Therefore, amounts set forth herein reflect RSUs granted in 20202021 and 2021;2022; no value is attributable for the 20222023 RSUs under “Termination without Cause or for Good Reason.” For Mr. Appio’s and Ms. Carson’s 2020, 2021, 2022 and 2022 BHC RSUs and Mr. Vadaketh’s 2022 BHC2023 RSUs, other than the BHC Retention RSU GrantsRSUs granted to Mr. Vadaketh and Ms. Carson on September 5, 2022, if Mr. Appio or Ms. Carson or Mr. Vadaketh terminates his or her service with us on or after age 55, and age plus years of service total at least 65, all unvested RSUs will vest. No values are shown for RSUs for Mr. Vadaketh and Ms. Carson under “Termination due to Retirement” because they wereshe was not retirement eligible as of December 31, 2022.2023. Further, because vesting upon a retirement requires the employee to be employed through the first anniversary of the grant date, no value is shown for the 20222023 RSUs above for “Termination due to Retirement” for Mr. Appio. |

(3)

| Pursuant to the terms of the equity award agreements governing Mr. Appio’s and Ms. Carson’s 2020 and 2021 BHC2023 PSUs, other than Mr. Appio’s September 21, 2021 Promotional PSU (the “Promotional PSU”), if Mr. Appio’s or Ms. Carson’s employment is terminated by us without cause, by Mr. Appio or Ms. Carson for good reason, or upon death or disability, they will be entitled to prorated vesting of unvested PSUs at actual performance as shown above under “Termination without Cause or for Good Reason” and “Termination due to Death or Disability.” If their employment is terminated by us without cause, or by Mr. Appio or Ms. Carson for good reason, in each case within 12 months of a change in control (or duringThis vesting treatment applies beginning after the six-month period prior to a change in control if such termination was in contemplation of, and directly related to, the change in control), unvested PSUs will vest pro-rata based on target performance through the termination date (or, if later, the date of the change in control). In the event the PSUs are not assumed or substituted in connection with the change in control, unvested PSUs will vest pro-rata based on target performance on the date of such change in control. For Mr. Appio’s or Ms. Carson’s 2020 and 2021 PSUs, other than Mr. Appio’s Promotion PSU, if Mr. Appio or Ms. Carson terminates his or her service with us on or after age 55, and age plus years of service total at least 65, any unvested portion of the PSU will vest pro-rata based on actual results. With respect to the BHC PSUs, other than the Promotional PSU, the amount reported reflects outstanding PSUs granted in 2020 and 2021. In connection with the B+L IPO, the Talent and Compensation Committee determined to adjust the terms of the BHC PSUs granted in 2020 to provide that ROTC performance in respect of the 2022 performance period will be deemed to be achieved at target as of the completion of the B+L IPO and determined to adjust the terms of the PSUs granted in 2021 other than the Promotional PSUs to provide that ROTC performance in respect of the 2022 performance period and the 2023 performance period will be deemed to be achieved at target as of the completion of the B+L IPO. Further, in connection with the B+L IPO, the Talent and Compensation Committee determined to adjust the terms of the BHC PSUs granted in each of 2020 and 2021, other than the Promotional PSU, to provide that the last day of the TSR performance period applicable to such PSUs will be the date of the completion of the B+L IPO, with actual achievement of the TSR performance metrics through such date. The 2020 and 2021 BHC PSUs, other than the Promotional PSU, have since been distributed on February 27, 2023, and March 3, 2023.first |

(4)Bausch Health Companies Inc.

| 60

| For Mr. Appio’s Promotional PSU, if Mr. Appio’s employment is terminated by us without cause, by Mr. Appio for good reason, including within 12 months of our change in control (or during the six-month period prior to a change in control if such termination was in contemplation of, and directly related to, the change in control), upon death or disability, or if Mr. Appio terminates his service with us on or after age 55, and age plus years of service total at least 65, Mr. Appio will be entitled to prorated vesting of unvested Promotional PSUs at actual performance as shown above under “Termination without Cause or for Good Reason,” “Termination due to Death or Disability,” “Termination due to Retirement” and “Termination within 12 months of a Change in Control.”2024 Proxy Statement |

TABLE OF CONTENTS anniversary of the grant date if they experience a termination of employment without cause or by the NEO for good reason. If their employment is terminated by us without cause, or by Mr. Appio or Ms. Carson for good reason, in each case within 12 months of a change in control (or during the six-month period prior to a change in control if such termination was in contemplation of, and directly related to, the change in control), unvested PSUs will vest pro-rata based on target performance through the termination date (or, if later, the date of the change in control). In the event the PSUs are not assumed or substituted in connection with the change in control, unvested PSUs will vest pro-rata based on target performance on the date of such change in control. For Mr. Appio’s or Ms. Carson’s 2023 PSUs, beginning after the first anniversary of the grant date, if Mr. Appio or Ms. Carson terminates his or her service with us on or after age 55, and age plus years of service total at least 65, any unvested portion of the PSU will vest pro-rata based on actual results. No values are shown for PSUs for Ms. Carson under “Termination due to Retirement” because she was not retirement eligible as of December 31, 2023. Further, because vesting upon a retirement requires the employee to be employed through the first anniversary of the grant date, no value is shown for the 2023 PSUs above for “Termination due to Retirement” for Mr. Appio. (5)(4)

| Pursuant to the terms of the equity award agreements governing Mr. Appio and Ms. Carson’s 2020, 2021 and 2022 BHC Stock Options and Mr. Vadaketh’Ms. Carson’ s 2022 BHC2023 Stock Options, if their employment is terminated by us without cause, or terminated by them for good reason, in either case within 12 months of a change in control (or during the six-month period prior to a change in control if such termination was in contemplation of, and directly related to, the change in control), or in the case of death or disability, unvested options will vest in full. For Mr. Appio and Ms. Carson’s 2021 and 2022 Stock Options and Ms. Carson’s 2023 Stock Options, beginning after the first anniversary of the grant date, if Mr. Appio or Ms. Carson terminate his or her service with us on or after age 55, and their age plus years of service total at least 65, all unvested options will vest. Ms. Carson was not retirement eligible as of December 31, 2023. As of December 31, 2023 outstanding Stock Options were not currently in-the-money, so no value is shown above. |

TABLE OF CONTENTS

For Mr. Appio and Ms. Carson’s 2020, 2021 and 2022 BHC Stock Options and Mr. Vadaketh’s 2022 BHC Stock Options, if Mr. Appio, Ms. Carson or Mr. Vadaketh terminate his or her service with us on or after age 55, and their age plus years of service total at least 65, all unvested options will vest. Mr. Vadaketh and Ms. Carson were not retirement eligible as of December 31, 2022. Outstanding Stock Options are not currently in-the-money, so no value is shown above.

(6)(5)

| Pursuant to the terms of the equity award agreements governing Mr. Appio’s B+L Founder RSU, if Mr. Appio’s employment is terminated by us without cause or by him for good reason, any unvested RSUs will vest pro-rata, and if Mr. Appio’s employment is terminated due to death or disability, all unvested B+L Founder RSUs will vest. Under this agreement, if Mr. Appio is terminated without cause or Mr. Appio resigns for good reason within 12 months of a change in control (or during the six-month period prior to a change in control if such termination was in contemplation of, and directly related to, the change in control), all unvested B+L Founder RSUs will vest. This vesting treatment applies beginning after the first anniversary of the grant date if Mr. Appio is terminated without cause or for good reason. Therefore, no value is shown above for Mr. Appio’s B+L Founder RSU under “Termination without Cause or for Good Reason.” |

(7)(6)

| If Mr. Vadaketh’sBarresi’s employment is terminated by us without cause, or by Mr. Vadaketh for good reason, or upon the expiration of his employment term, Mr. VadakethBarresi will be entitled to receive a cash severance payment equal to the sum of one and a half times annual base salary and annual target incentive payable in a lump sum, a prorated annual incentive for the year of termination equal to the lesser of the annual incentive based on our actual performance and annual target incentive, and continued health benefits at active employee rates for one year, as shown above under “Termination without Cause or for Good Reason.” If such termination occurs in contemplation of our change in control or within 12 months following our change in control, Mr. VadakethBarresi will be entitled to receive a cash severance payment equal to two times the sum of annual base salary and annual target incentive payable in a lump sum, a prorated annual target incentive for the year of termination and continued health benefits for one year at active employee rates, as shown above under “Termination within 12 months of a Change in Control.” Upon |

(7)

| Pursuant to the terms of the equity award agreements governing Mr. Barresi’s 2022 and 2023 RSUs, if Mr. Barresi’s employment is terminated by us without “cause”, his unvested RSUs will vest pro-rata and, if his employment is terminated due to death or disability, all unvested RSUs will vest. Under these agreements, if he is terminated without cause within 12 months of a change in control, all unvested RSUs will vest. This vesting treatment applies beginning after the first anniversary of the grant date in connection with a termination of employment without cause. Therefore, amounts set forth herein reflect RSUs granted in 2022; no value is attributable for the 2023 RSUs under “Termination without Cause or for Good Reason.” For Mr. Vadaketh (orBarresi’s, 2022 and 2023 RSUs, other than the Retention RSUs granted to Mr. Barresi on September 5, 2022, if Mr. Barresi terminates his beneficiaries)service with us on or after age 55, and age plus years of service total at least 65, all unvested RSUs will vest. No values are shown for RSUs for Mr. Barresi under “Termination due to Retirement” because he was not retirement eligible as of December 31, 2023. |

(8)

| Pursuant to the terms of the equity award agreements governing Mr. Barresi’s 2023 PSUs, if Mr. Barresi’s employment is terminated by us without cause, or upon death or disability, he will be entitled to receive (i)prorated vesting of unvested PSUs at actual performance as shown above under “Termination without Cause or for Good Reason” and “Termination due to Death or Disability.” This vesting treatment applies beginning after the earned but unpaid bonus fromfirst anniversary of the fiscal year prior to the fiscal year of hisgrant date if Mr. Barresi experience a termination of employment and (ii) a prorated bonus, measured at target,without cause. Therefore, no value is attributable for the year2023 PSUs under “Termination without Cause or for Good Reason.” If his employment is terminated by us without cause within 12 months of termination.a change in control, unvested PSUs will vest pro-rata based on target performance through the termination date (or, if later, the date of the change in control). In the event the PSUs are not assumed or substituted in connection with the change in control, unvested PSUs will vest pro-rata based on target performance on the date of such change in control. Beginning after the first anniversary of the grant date, if Mr. Barresi terminates his service with us on or after age 55, and age plus years of service total at least 65, any unvested portion of the PSUs will vest pro-rata based on actual results. No values are shown for RSUs for Mr. Barresi under “Termination due to Retirement” because he was not retirement eligible as of December 31, 2023. |

(8)(9)

| Pursuant to the terms of the equity award agreements governing Mr. Barresi’s 2022 and 2023 Stock Options, if his employment is terminated by us without cause, within 12 months of a change in control, or in the case of death or disability, unvested options will vest in full. Beginning after the first anniversary of the grant date, if Mr. Barresi terminates his service with us on or after age 55, and his age plus years of service total at least 65, all unvested options will vest. Mr. Barresi was not retirement eligible as of December 31, 2023, so no value is shown above. |

(10)

| If Ms. Carson’s employment is terminated by us without cause, or by Ms. Carson for good reason, Ms. Carson will be entitled to receive a cash severance payment equal to the sum of one and a half times annual base salary and annual target incentive payable in a lump sum, a prorated annual incentive for the year of termination equal to the lesser of the annual incentive based on our actual performance and annual target incentive, a cash payment equal to the remaining B+L Separation Bonus and continued health benefits at active employee rates for one year, as shown above under “Termination without Cause or for Good Reason.” If such termination occurs in contemplation of our change in control or within 12 months following oura change in control, Ms. Carson will be entitled to receive a cash severance payment equal to two times the sum of annual base salary and annual target incentive payable in a lump sum, a prorated annual target incentive for the year of termination and continued health benefits for one year at active employee rates, as shown above under “Termination within 12 months of a Change in Control.” With respect to any termination of employment, (i) Ms. Carson remains eligible to (i) receive payments and/or benefits under the Canadian Employment Standards Act 2000 (the “ESA”) or other applicable law and (ii) any payments and/or benefits Ms. Carson receives under the ESA or other applicable law will offset any payments she would receive under the Carson Agreement and, if the payments and/or benefits provided by the ESA or other applicable laware greater than those set forth in the Carson Agreement, then Ms. Carson will not receive any payments under the Carson Agreement or other severance plan or policy of BHC. |

(9)

| As shown above under “Termination without Cause or for Good Reason” and “Termination within 12 months of a Change in Control,” the Papa Separation Agreement provides for a lump sum cash payment equal to two times the sum of Mr. Papa’s current base salary and target annual bonus, earned but unpaid annual bonus for the year prior to his termination date, and a pro-rata annual bonus based on actual performance. Under the A&R Papa Separation Agreement, the prorated annual bonus will be equal to his target annual bonus, prorated by fifty percent. As shown above under “Termination due to Death or Disability,” if Mr. Papa’s employment is terminated for death or disability, he would his receive earned but unpaid annual bonus for the year prior to his termination date. |

(10)

| As shown above under “Termination without Cause or for Good Reason,” Mr. Papa’s B+L Founder Awards will partially vest upon his termination of service (315,592 RSUs and 1,248,496 Stock Options), but the shares received upon settlement of such B+L Founder RSUs will remain fully restricted and nontransferable until the Unrestricted Date, and the B+L Founder Stock Options will vest and become exercisable on the Unrestricted Date and will be exercisable for two years following the Unrestricted Date. As shown above under “Termination within 12 months of a Change in Control” and “Termination due to Death or Disability,” the B+L Founder RSUs and B+L Founder Stock Options fully vest. Outstanding Stock Options are not currently in-the-money, so no value is shown. |

(11)

| As shown above under “Termination without Cause or for Good Reason,” the treatment of Mr. Papa’s BHC equity awards will be consistent with their terms for a termination due to retirement and, for Mr. Papa’s program Separation PSUs, by B+L without cause. As shown above under “Termination within 12 months of a Change in Control” and “Termination due to Death or Disability,” Mr. Papa’s outstanding BHC RSUs and Stock Options would fully vest and his PSUs would pro-rata vest, except for the Separation PSUs, which would fully vest upon a “Termination within 12 months of a Change in Control.” Outstanding Stock Options are not currently in-the-money, so no value is shown above. With respect to the PSUs, the amount reported reflects outstanding BHC PSUs granted in 2020 and 2021. In connection with the IPO, the Talent and Compensation Committee determined to adjust the terms of the PSUs granted in 2020 to provide that ROTC performance in respect of the 2022 performance period will be deemed to be achieved at target as of the completion of the IPO. In connection with this offering, the Talent and Compensation Committee determined to adjust the terms of the PSUs granted in 2021 to provide that ROTC performance in respect of the 2022 performance period and the 2023 performance period will be deemed to be achieved at target as of the completion of the IPO. Further, in connection with the IPO, the Talent and Compensation Committee determined to adjust the terms of the PSUs granted in each of 2020 and 2021 to provide that the last day of the TSR performance period applicable to such PSUs will be the date of the completion of the IPO, with actual achievement of the TSR performance metrics measured by the Talent and Compensation Committee through such date. The 2020 and 2021 PSUs have since been distributed on February 26, 2023, and March 3, 2023. |

(12)

| The Papa Separation Agreement provides for continued health benefits for two-years at active employee rates and reimbursement of legal fees incurred. |

(13)

| As shown above under “Termination without Cause or for Good Reason,” the severance benefits payable to the Former B+L NEOs (other than Mr. Papa) provide that in the event of an involuntary termination of employment by B+L without cause or resignation for good reason, in each case within one-year following the B+L’s appointment of Mr. Papa’s successor, then the executive will be eligible to receive a cash severance payment equal to two times the sum of his or her annual base salary and annual target incentive award, plus payment of his or her annual cash bonus award for the year of termination (based on actual achievement of applicable performance goals and prorated based on the number of days employed during the year). As shown above under “Termination within 12 months of a Change in Control,” if the former B+L NEOs (other than Mr. Papa) are terminated without cause, or for good reason, in contemplation of a change in control or within 12 months following a change in control, they will receive a cash severance payment equal to two times the sum of his or her annual basepolicy. |

68Bausch Health Companies Inc. | 61

| 2024 Proxy Statement |

TABLE OF CONTENTS salary and annual target incentive award, plus payment of his or her annual cash bonus award for the year of termination (based on target achievement and prorated based on the number of days employed during the year). As shown above under “Termination without Cause or for Good Reason” and “Termination within 12 months of a Change in Control.” Mr. Eldessouky and Ms. Ackermann would also receive a cash payment equal to the remaining 50% of the separation bonus upon a qualifying termination.

(14)

| As shown above under “Termination without Cause or for Good Reason,” the B+L Founder RSUs issued to the Former B+L NEOs (other than Mr. Papa) in May 2022 will partially vest upon their termination of service date on a pro-rata basis, but the shares received upon settlement will remain fully restricted and nontransferable until the Unrestricted Date, and the B+L Founder Stock Options issued will vest and become exercisable on the Unrestricted Date on a pro-rata basis and will be exercisable for two years following the Unrestricted Date. As shown above under “Termination within 12 months of a Change in Control” and “Termination due to Death or Disability,” the B+L Founder RSUs and the B+L Founder Stock Options fully vest. In addition, each of our NEOs (other than Mr. Papa) was granted a one-time award of RSUs under the Retention Program, which will fully vest as shown above under “Termination without Cause or for Good Reason,” “Termination within 12 months of a Change in Control” and “Termination due to Death or Disability.” Outstanding Stock Options are not currently in-the-money, so no value is shown above. |

(15)

| As shown above under “Termination without Cause or for Good Reason,” the treatment of the Former B+L NEO’s (other than Mr. Papa) BHC equity awards will be treated in accordance with the terms of their governing grant agreements. As shown above under “Termination within 12 months of a Change in Control” and “Termination due to Death or Disability,” their outstanding BHC RSUs and Stock Options would fully vest and the PSUs would pro-rata vest. Outstanding Stock Options are not currently in-the-money, so no value is shown above. With respect to the PSUs, the amount reported reflects outstanding BHC PSUs granted in 2020 and 2021. In connection with the IPO, the Talent and Compensation Committee determined to adjust the terms of the PSUs granted in 2020 to provide that ROTC performance in respect of the 2022 performance period will be deemed to be achieved at target as of the completion of the IPO. Further, in connection with the IPO, the Talent and Compensation Committee determined to adjust the terms of the PSUs granted in each of 2020 and 2021 to provide that the last day of the TSR performance period applicable to such PSUs will be the date of the completion of the IPO, with actual achievement of the TSR performance metrics measured by the Talent and Compensation Committee through such date. In connection with this offering, the Talent and Compensation Committee determined to adjust the terms of the PSUs granted in 2021 to provide that ROTC performance in respect of the 2022 performance period and the 2023 performance period will be deemed to be achieved at target as of the completion of the IPO. The 2020 and 2021 PSUs have since been distributed on February 27, 2023, and March 3, 2023. |

(16)

| The severance benefits payable to the former B+L NEOs (other than Mr. Papa) provide for continued health benefits for two years at active employee rates, and for Ms. Ackermann, outplacement support. |

2022 Pay Ratio Disclosure

Pay Ratio In accordance with the requirements of Section 953(b) of the Dodd-Frank Act and Item 402(u) of Regulation S-K (which we collectively refer to as the “Pay Ratio Rule”), we are providing the following estimated information for 2022:2023: the median of the annual total compensation of all our employees (excluding our CEO) was $54,304;$ 44,328; the annual total compensation of our CEO was $13,171,461;$15,878,578; and the ratio of these two amounts was 243358 to 1. We believe that this ratio is a reasonable estimate calculated in a manner consistent with the requirements of the Pay Ratio Rule. Methodology for Identifying Our Median Employee Employee Population To identify the median of the annual total compensation of all of our employees (other than our CEO), we first identified our total employee population from which we determined our median employee. We determined that, as of December 31, 2022, our employee population consisted of approximately 19,900 individuals (of which 12,900 were B+L employees and of which approximately 33% were located in the United States and 67% were located in jurisdictions outside the United States). As permitted by the Pay Ratio Rule, we adjusted our total employee population (as described above) for purposes of identifying our median employee by excluding approximately 50 of our employees located in certain jurisdictions outside of the United States given the relatively small number of employees in those jurisdictions (less than 10), as follows: Austria, Bosnia & Herzegovina, Lithuania, Montenegro, New Zealand, Panama, Peru, and Philippines. After taking into account the above described adjustments to our employee population as permitted by the Pay Ratio Rule, our total adjusted employee population for purposes of determining our median employee consisted of approximately 19,850 individuals. Determining our Median Employee To identify our median employee from our adjusted employee population, we compared the amount of base salary of our employees as reflected in our payroll records and converted to U.S. Dollars. In making this determination, we annualized the compensation of our full-time employees, including those who were hired in 2022 (but did not work TABLE OF CONTENTS

for us for the entire fiscal year) and permanent part-time employees (reflecting what they would have earned if they had worked the entire year at their part-time schedule). We identified our median employee using this compensation measure, which was consistently applied to all our employees included in the calculation. There has been no change in our employee population or employee compensation arrangements that we believe would significantly impact the pay ratio disclosure and, as a result, we have used the same median employee identified on April 6, 2023. Determination of Annual Total Compensation of our Median Employee and our CEO Once we identified our median employee, we then calculated such employee’s annual total compensation for 20222023 by using the same methodology we used for purposes of determining the annual total compensation of our NEOs for 20222023 as set forth in the 20222023 Summary Compensation Table on page 5955. Our CEO’s annual total compensation for 20222023 for purposes of the Pay Ratio Rule is equal to the amount reported in the “Total” column in the 20222023 Summary Compensation Table. Please note that SEC rules for identifying the median employee and calculating the pay ratio allow companies to apply various methodologies and apply various assumptions and, as result, the pay ratio reported by us may not be comparable to the pay ratio reported by other companies. 70Bausch Health Companies Inc. | 62

| 2024 Proxy Statement |

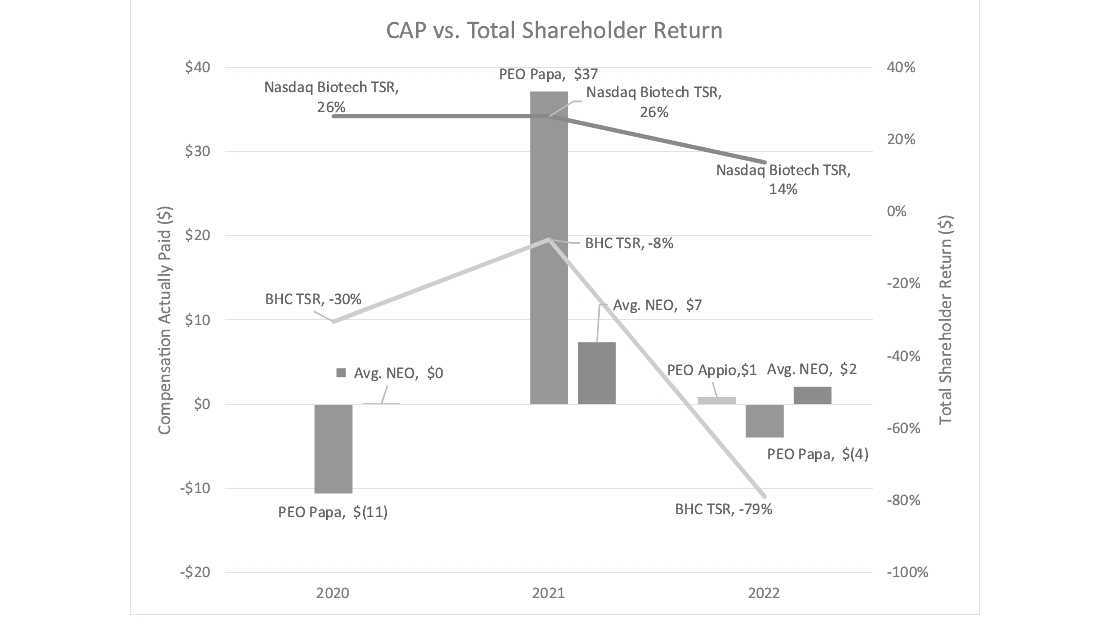

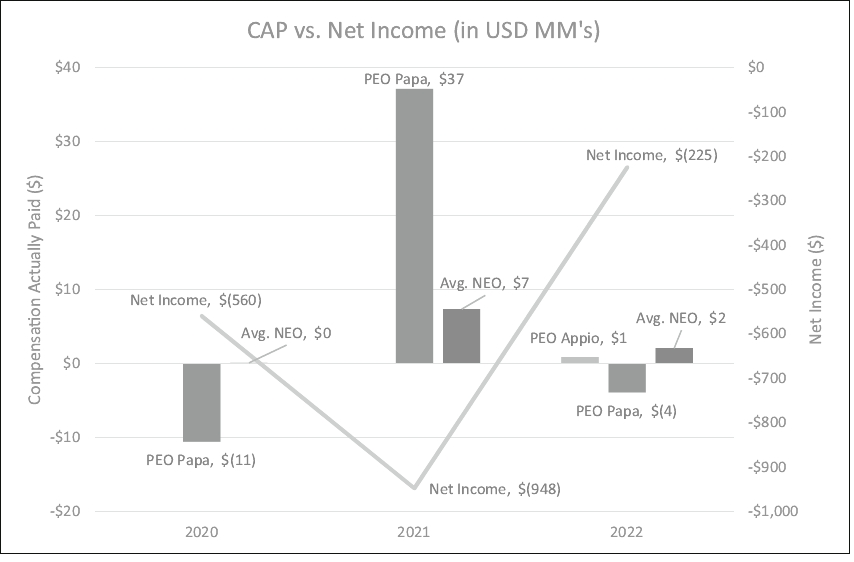

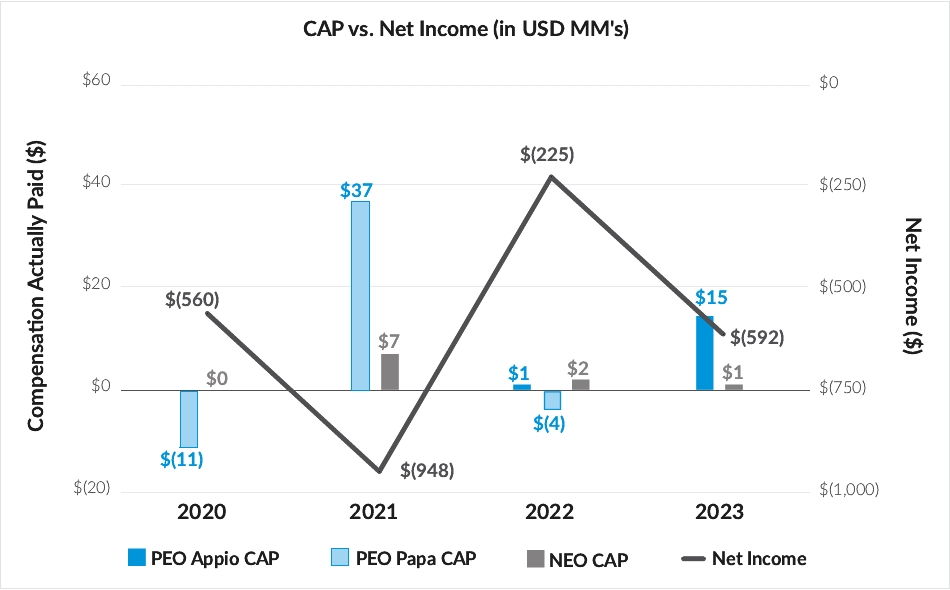

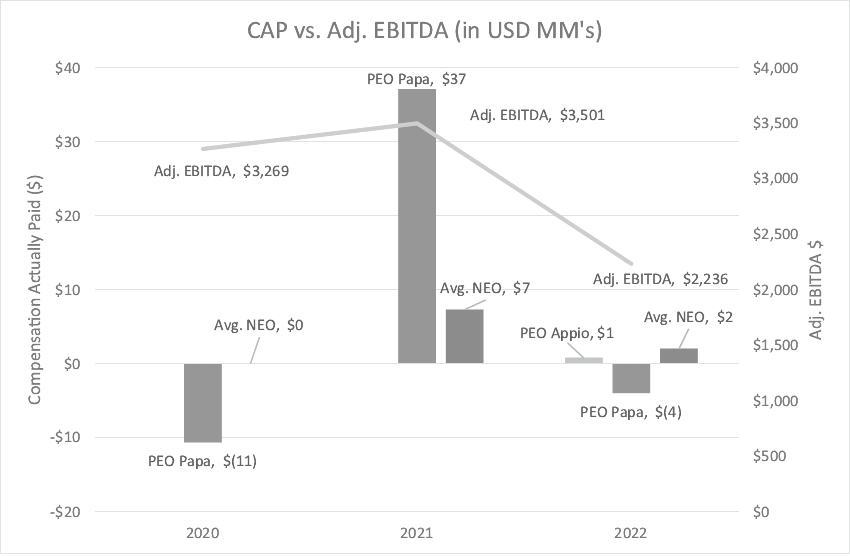

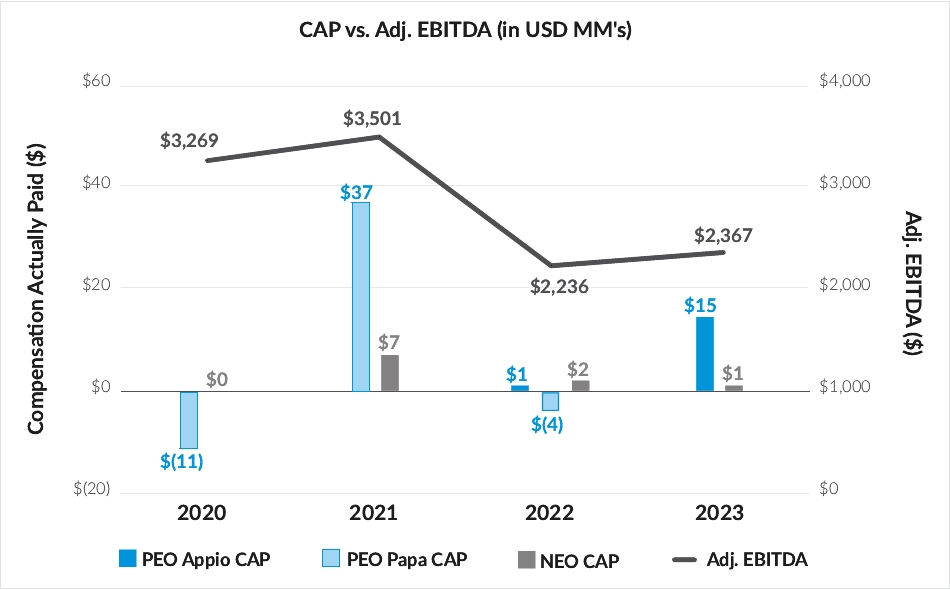

TABLE OF CONTENTS PAY VERSUS PERFORMANCE The following table sets forth the compensation for our Principal Executive Officers (the “PEOs”) and the average compensation for our other named executive officers, both as reported in the Summary Compensation Table and with certain adjustments to reflect the “compensation actually paid” to such individuals, as defined under SEC rules, for each of 2023, 2022, 2021 and 2020. The table also provides information on our cumulative total shareholder return (“TSR”), the cumulative TSR of our peer group, Net Income and Adjusted EBITDA (non-GAAP) as used for our 2023, 2022, 2021 and 2020 annual incentive plans (“AIP”). AIP.2022 | | | $13,171,461 | | | $821,019 | | | $19,781,761 | | | ($3,950,168) | | | $5,683,018 | | | $2,050,535 | | | $21 | | | $114 | | | ($225) | | | 2,236 | 2021 | | | — | | | — | | | $22,889,137 | | | $37,122,606 | | | $5,972,466 | | | $7,337,740 | | | $92 | | | $126 | | | ($948) | | | 3,501 | 2020 | | | — | | | — | | | $14,119,361 | | | ($10,609,802) | | | $4,287,738 | | | $61,287 | | | $70 | | | $126 | | | ($560) | | | 3,269 |

| | 2023 | | | 15,878,578 | | | 14,834,961 | | | — | | | — | | | 2,843,374 | | | 1,029,672 | | | 27 | | | 119 | | | (592) | | | 2,367 | | | | 2022 | | | 13,171,461 | | | 821,019 | | | 19,781,761 | | | (3,950,168) | | | 5,683,018 | | | 2,050,535 | | | 21 | | | 114 | | | (225) | | | 2,236 | | | | 2021 | | | — | | | — | | | 22,889,137 | | | 37,122,606 | | | 5,972,466 | | | 7,337,740 | | | 92 | | | 126 | | | (948) | | | 3,501 | | | | 2020 | | | — | | | — | | | 14,119,361 | | | (10,609,802) | | | 4,287,738 | | | 61,287 | | | 70 | | | 126 | | | (560) | | | 3,269 | |

(1)

| Compensation for our PEOs reflects the amounts reported in the “Summary Compensation Table” for the respective years. Our PEOs were (i) in 2023 Thomas J. Appio; (ii) in 2022, Thomas J. Appio and Joseph C. Papa and (ii) in 2021 and 2020, Joseph C. Papa. Average compensation for non-PEOs includes the following named executive officers: (i) in 2023, John S. Barresi, Seana Carson and Tom G. Vadaketh, (ii) in 2022, Tom G. Vadaketh, Seana Carson, Robert A. Spurr, Sam A. Eldessouky and Christina Ackermann, (ii)(iii) in 2021, Thomas J. Appio, Robert A. Spurr, Sam A. Eldessouky, Christina M. Ackermann, and Paul S. Herendeen and (iii)(iv) in 2020, Thomas J. Appio, Paul S. Herendeen, Christina M. Ackermann, and William D. Humphries. |

(2)